I don't know when you travel or what room sizes you book, but if you go in peak season for HHI (summer), a 2BR costs 337 points per week which at $11.31/pp is about $3800 in annual dues. Is the DVC resort in SC it worth it when there are no theme parks to go along with it? Is it that much more special than other options? Why not keep AKV, rent those points out, and use the cash to book HHI outside of the DVC bubble? And if you don't want to pay dues past 2042 you can sell AKV in 2042, while it still has 15 years left.

We've actually never been to HHI, at DVC or otherwise, so I honestly don't know the answers to the questions I was asking. But we own multiple Marriott Vacation Club weeks and so I happen to know MVC has about 8 separate resorts on HHI (Barony Beach Club, Grande Ocean, Harbour Club, Harbour Point, Heritage Club, Monarch, Sunset Pointe, Surfwatch). You could probably book a summer 2BR unit in some of these directly on

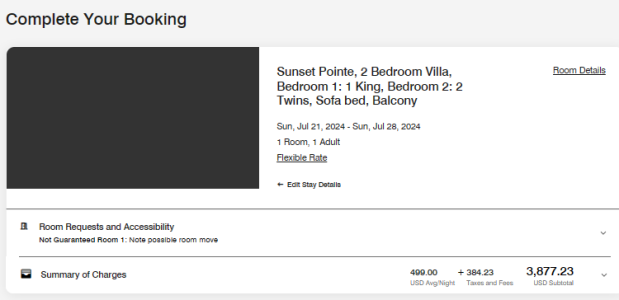

marriott.com for less than $4000 per week (I checked - see below).

Here's an option directly available via

marriott.com that will cost you about as much as the dues on a 2BR DVC HHI week (no "owner discount" used). Renting from a deeded week owner on Redweek or asking an owner to book shorter stays with points via the owner-created website

vacationpointexchange.com would probably cost you substantially less - but these probably require more "trust factor" and common sense fraud prevention measures. In addition, some of those Marriott

points charts are extremely favorable in the offseason. For example - a full week in a 2BR in December or January for 400 MVC points (which can be rented for about $300!). It'd be 146 points with DVC.

View attachment 809388