Galactic Reversal

Mouseketeer

- Joined

- Apr 12, 2023

A thread for any questions/comments/suggestions regarding dvcrofr.com. I'll do my best to address all in a timely manner.

Thanks! I opted to not adjust for trend, contract size, or use year, in the suggested range. However, if you scroll down a bit on the tool you’ll find suggestions on how to adjust for those using data going back 12 months.Brilliant site! You must have put a lot of hours in to this!! Just one question, the pricing tool is giving a lower suggested price for a 25 point contract than a 200 point contact (SSR). Does it take in to account the possible higher value attributed to smaller contracts or is this dependent on the data that is used?

Thanks! Yeah, I went back and forth on it. Just to be clear, outliers are excluded whether they are high or low and the data submitted to this site are likely a bit lower than the overall market due to voluntary response bias.Very nice site. Thanks for sharing it here.

I could be alone but I don’t think that the “outliers” should be excluded from the data.

If the outliers would skew the results than uneducated buyers that pay asking price at some sites should be excluded too.

Agreed, you're not the first to mention and it's definitely near the top of the to-do list.Great site! I played with it for about 10 minutes and have the following comments:

1) Not sure if it's possible to do, but it probably makes sense to split AUL and AUL subsidized (like you did with OKW and OKW-Extended). There are reasons in both cases why one subset sells for 30%-40% more than the other.

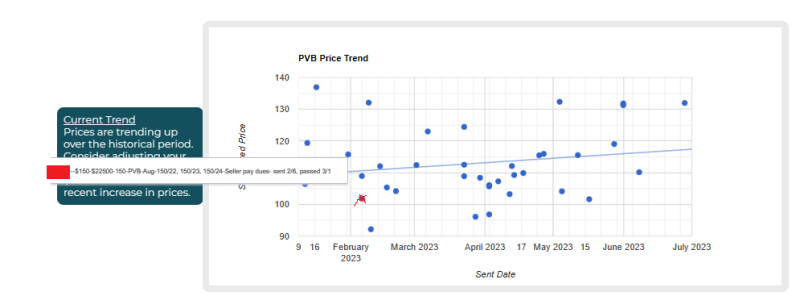

I would argue around $15/point seems pretty accurate given it's about the rental income that could be generated. So everything is based on discounted cash flows. The data from this site is normalized to account for the timing of points and closing costs. The normalized prices equate each contract with a reference contract will full points and standard dues/closing costs. In the pricing tool, the normalized data is transformed again (into "suggested" prices) to account for the particulars of the contract being priced. These are the data points you are seeing in the histogram and scatter plot. By the way, if you hover over the data points in the charts you can see the original data strings containing the actual price that person paid.2) The pricing tool seems to value stripped points at around $15/point. For example, it priced a June 150pt Poly contract with 2023 and 2024 points included at around $140 and without those points at around $110. That difference seems excessive to me - for comparison, the DVC Resale Market pricing tool prices stripped points at $6-$7. There is also a histogram and scatterplot on that page showing data in the $90s? Is that accurate? Are there any actual resale transactions for Poly at $90-$110?

The data comes from the ROFR threads. It is updated throughout the day and dates back to 2016. I would ask people to enter it directly on my site, but it's not well-known enough...I'd be lucky to get 5-10% of the people who post their data in these message boards. It would be nice though, the censorship on these boards is limiting.3) Where is the data coming from? Can users enter date directly into the site?

I would argue around $15/point seems pretty accurate given it's about the rental income that could be generated. So everything is based on discounted cash flows. The data from this site is normalized to account for the timing of points and closing costs. The normalized prices equate each contract with a reference contract will full points and standard dues/closing costs. In the pricing tool, the normalized data is transformed again (into "suggested" prices) to account for the particulars of the contract being priced. These are the data points you are seeing in the histogram and scatter plot. By the way, if you hover over the data points in the charts you can see the original data strings containing the actual price that person paid.

There is also a histogram and scatterplot on that page showing data in the $90s? Is that accurate? Are there any actual resale transactions for Poly at $90-$110?

These are the data points you are seeing in the histogram and scatter plot. By the way, if you hover over the data points in the charts you can see the original data strings containing the actual price that person paid.

I think you may be forgetting to adjust the 'Buyer Costs at Closing' input box. For the stripped contract it should be the closing costs less the 2024 dues paid by the seller (probably a negative). If that input is not set correctly, the discount from the seller-paid dues will be reflected in the suggested price, which I'm sure you know is not how the brokers list them.But it's not $15 over maintenance fees...

If you get resale 2023 points, you'd have to pay annual does on those and maybe you can rent them and get $8-$10 over that, but probably not at $15 over the annual dues. If those 2023 points are stripped, you can argue that you now have to go and rent points instead, so that's a cost of $15-$20, but many buyers wouldn't care that much if they don't need the points immediately and the contract is the right size and right use year.

If you get banked 2022 points, it's more ambiguous. You actually don't pay annual dues on those so maybe you make a reservation and rent it out or maybe you just use them. The value someone would place on that can vary more widely - anywhere from $8 (using) to $20 (renting).

To me it's more of a "smell test", I doubt a "regular" $140 contract with current and next year points would sell as low as $110 if fully stripped. In fact, there's a whole cottage industry of "investors" doing buy/strip/sell with certain contracts.

Hover over a data point on the histogram and you'll see a price under the data string. That is the suggested price that is calculated for the contract in question based on that data point. The suggested prices are the vertical axis. If you want to see a plot of the raw prices and normalized prices by resort, check out the individual resort pages under the Pricing Trends dropdown menu.Regarding my point about the histograms and scatterplots that seem incorrect and your response about hovering over the data, this still seems off.

Are the price points supposed to match the left axis? Maybe I'm reading incorrectly but in the example below it says $150 on the "hover" rofr data but the dot is plotted at ~$102. All the dots on that chart seem mismatched relative to the vertical axis.

View attachment 776385

My hubby got his Masters win data science not too long ago. Going to share this with him to blend our two loves!Thanks! Yeah, I went back and forth on it. Just to be clear, outliers are excluded whether they are high or low and the data submitted to this site are likely a bit lower than the overall market due to voluntary response bias.

I tried to strike a balance between using the latest information and using enough data to make a credible estimate. Since there's not a lot of data, the outliers can greatly skew results. That's ultimately why I went with removal, but I still put them in the report for transparency and so people can draw their own conclusions.