DeeCee735

"How Do You Know of the Key?"

- Joined

- Mar 1, 2001

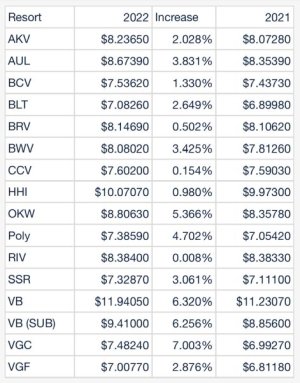

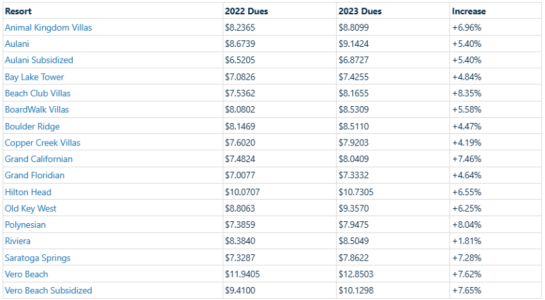

Me too! Whew! Paying BWV, AKV and a Marriott week! Life is good, but expensiveAfter many years of really high percentages of BWV dues increases, I'm beyond thrilled to see this tiny amount of increase! woohoo! They're high enough!