linzjane88

Closet Disneyphile

- Joined

- Jan 4, 2014

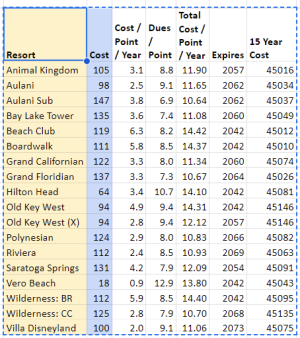

For fun I was playing with my DVC spreadsheet and since many of the 15 year costs on 150 points for various resorts were in the 40-50k range I decided to alter the purchase price to show what damage dues can do. I wanted to see how close I could get the total 15 year cost to 45k (factoring in current annual dues increasing by 5% each year) by playing around with the per point buy in price.

This shows just how intensely those annual dues eat into your 'savings' when buying points. Getting 150 Vero Beach points at $18 per point would cost you the same in 15 years as having bought BLT for $135 PP!

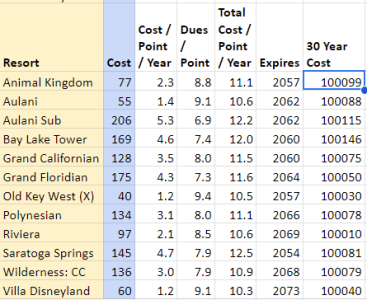

This is showing the 30 year mark, trying to hit 100K as the total all in cost:

The main takeaway is that Aulani subsidized, VGF, BLT, SSR are definitely the prime SAP targets and can tolerate a decent increase in the purchase price before it really makes a dent. I am sure there are a million flaws in my worksheet but it entertains me anyhow.

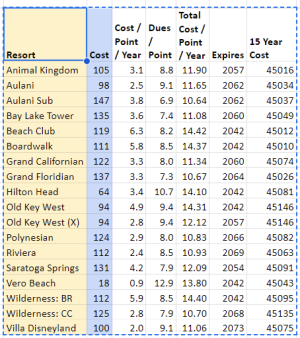

This shows just how intensely those annual dues eat into your 'savings' when buying points. Getting 150 Vero Beach points at $18 per point would cost you the same in 15 years as having bought BLT for $135 PP!

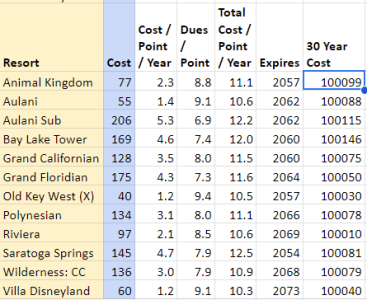

This is showing the 30 year mark, trying to hit 100K as the total all in cost:

The main takeaway is that Aulani subsidized, VGF, BLT, SSR are definitely the prime SAP targets and can tolerate a decent increase in the purchase price before it really makes a dent. I am sure there are a million flaws in my worksheet but it entertains me anyhow.