Monthly update!

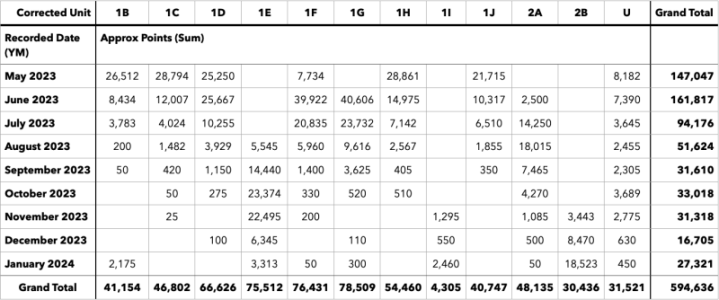

Total points recorded as of January 31st:

~595k points (18.3% of all points).

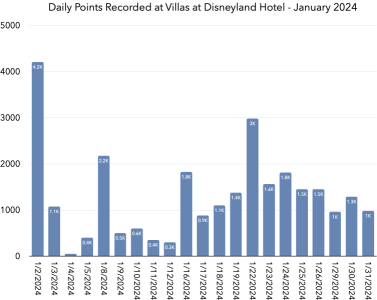

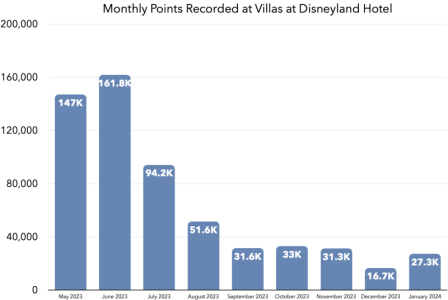

Points recorded in January:

~27.3k points.

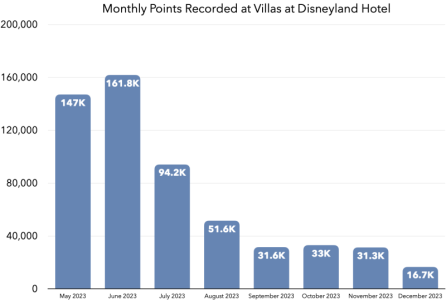

Not as bad as December (16.7k), but 27.3k is still lower than the pre-December low (31.3k).

At the current rate, VDH will sell out in a whopping 97 months, roughly early 2032!

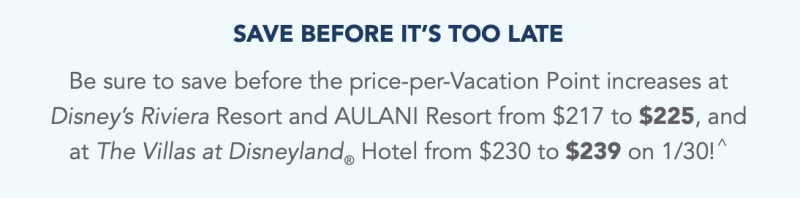

Despite this, DVC hasn't ramped up incentives at all and prices even went up on Feb 1. I speculated that the reason they didn't ramp up incentives in 2023 was due to avoiding over-selling compared to forecast. But now we're in 2024 and post-incentive prices has only gone up, indicating to me they're just fine with this sales pace.

As of January 31st, ~22.3% of points are declared and at least ~18.3% of the resort has been sold. That leaves less than 4% of headroom, roughly 130k points, before more Units

must be declared.

Also of note, OCRW made sales monitoring a tad more difficult with a recent change. Previously, OCRW would publish the Lot Number, the Transfer Tax Amount, and the Unit #. Now they just post Transfer Tax and Unit #, making it harder to differentiate VGC sales from VDH. Yes, DVC has been selling a trickle of VGC this entire time.

Also on the horizon is the new, increased, base price for VDH. This will change the Transfer Tax Amount for any given contract, but it may be hard to determine how many points are in a contract while there's a mix of both $239 and $230 base price contracts being recorded.

Base price change and OCRW changes mean the accuracy of this reporting will be reduced slightly, but I'll do my best to filter as well as possible.

As a reminder, I'm just doing ad hoc and monthly updates now.

Fun facts about January's sales:

Nothing particularly remarkable about mega-contracts, but there was one 653pt contract and another 600pt.

The 653pt is very likely a fixed week 2BR in Season 7 (Spring Break or Christmas/NYE). This is the 2nd 653pt contract recorded, the other came in June 2023. There was also a 222/223pt contract, likely a fixed week Standard View Deluxe Studio for Season 7.

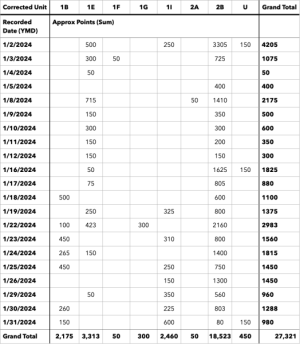

Unit 2B was the top seller again, roughly two thirds of all sales this month. Unit 1E was a distant 2nd at 12%. Curiously, there was a burst of 1B contracts being recorded. 1B was last recorded in September.

It is likely that a bunch of Units are now sold out: 1B, 1C, 1D, 1F, 1G, 1H, and maybe 1J. We still haven't seen 1A show up in any recorded deeds yet. I'm also not sure how many Units are in Phase 2, but we've only seen Unit 2A and Unit 2B from Phase 2 so far, but I suspect there's at least 2C, possibly also 2D.

Other interesting facts about the contracts recorded in November:

- 168 contracts recorded

- 79x 150pt contracts (43 the prior month)

- 19x 50pt contracts (14 the prior month)

- 16x 200pt contracts (17 the prior month)

- 11x 100pt contracts (11 the prior month)

- 10x 250pt contracts (7 the prior month)

- 9x 300pt contracts (4 the prior month)

- 24x other contracts (11 the prior month)

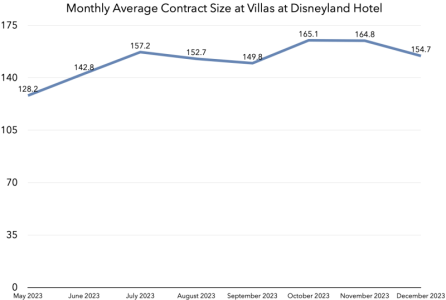

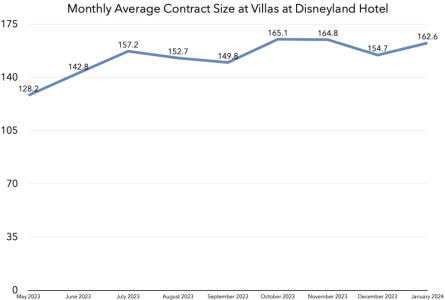

- 162.6pt average contract size in January

- May had an average of 128.2pt

- June had an average of 142.8pt

- July had an average of 157.2pt

- August had an average of 152.7pt

- September had an average of 149.8pt

- October had an average of 165.1pt

- November had an average of 164.8pt

- December had an average of 154.7pt

- 653pt is largest contract in January

- 50pt is smallest contract

- 400pt is the largest contract size purchased multiple times (4x)

- Unit 2B was assigned the most (18.5k, 2nd most was 1E at 3.3k)

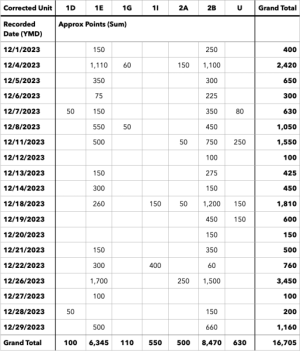

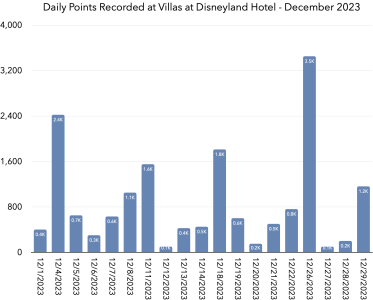

Points recorded by date:

View attachment 834760

"U" unit stands for "Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

View attachment 834761

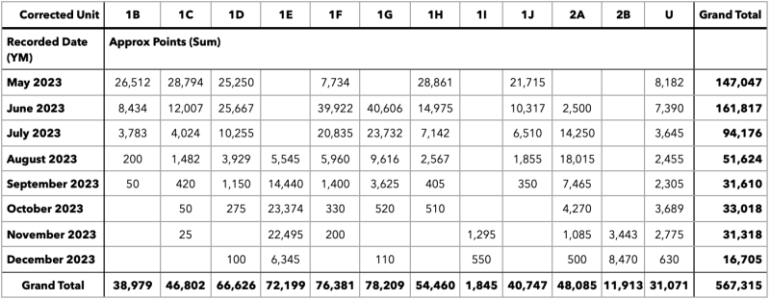

Points recorded by month:

View attachment 834762

View attachment 834763

View attachment 834764

View attachment 834765