While I can try to make some comparisons, on the

Disneyland website it no longer shows cash bookings for VDH???

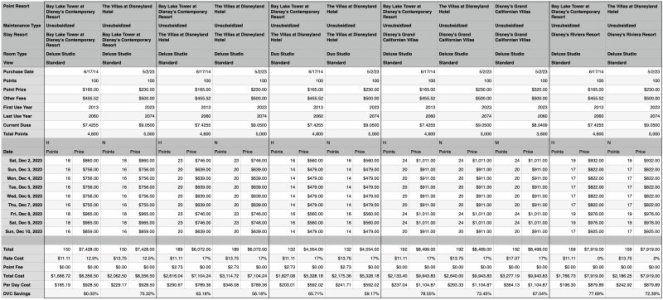

Example Trip Dec 8-12,2023 I usually value my points if I am renting at $21-$22 so for these example I will use $21.50

2-Bedroom

VDH points- 258 points + $705.30 in TOT

VDH points if renting out = $5547 + $705.30 = $6252.30

VDH Cash from when I called a couple months ago = $7578.00 + $1288.26 tax = $8866.26

VGC- 234 points

VGC is the clear winner, but I am most likely not able to get those rooms, as many are already booked at this point and at 7 month mark not able to get.

I would still have VDH points second as the renting price is still $2400 different than cash booking

Example Trip March 15-19, 2024

VDH points- 280 + $ 789.60 in TOT

VGC - 316

While VDH wins with points, the TOT adds an additional 37 points if I were to divide the tax by $21.50 which means the real stay would be 317, a point more than VGC

None of these numbers include the parking which would also have VGC be the winner in my mind.

Hopefully this can help someone decide to book VDH or think about getting a contract.

I have seen that people are not worried about this TOT for those that like to rent out their points, but the whole idea of getting a VDH is to have a Disneyland Resort. If you are using VDH points to book RIV, I would just say get RIV points, they are cheaper and better incentives most likely. If you are just using the VDH points for VDH which I have seen many say on threads and Facebook, then you are the one paying the tax as well which makes your total cost much more. This TOT will bite them and I don't think it can go away as it is from the city of Anaheim.

Staying offsite will most likely be how we work unless the family is okay with the addition of the TOT.