How do you feel about aggressive asset allocation when retirement is just a few years away? 60 years old, retiring in 3 years with a pension that will cover our monthly expenses. Retirement assets are 40/40/20 (stocks, international stocks, bonds). We will have no need to touch this money until RMDs are required.

Are we being too aggressive?

I'm inclined to think not since we can weather the ups and downs of the market. The pension income provides us with security so we can be a bit more aggressive.

I'd love the thoughts of others.

Are we being too aggressive?

I'm inclined to think not since we can weather the ups and downs of the market. The pension income provides us with security so we can be a bit more aggressive.

I'd love the thoughts of others.

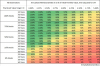

I am happy to be somewhere in the 90th percentiles. Thought there is a weird jump between ages 49 and 50. We are doing much better as 50 years olds than 49. lol (we will both be 50 this year) At what point are you happy with your numbers? Are you striving to be 1%ers? Though I guess you could be 1% at 30 and then if you did FIRE would that be enough? So many variables. I guess I need to stick to not comparing with others because every situation is different.

I am happy to be somewhere in the 90th percentiles. Thought there is a weird jump between ages 49 and 50. We are doing much better as 50 years olds than 49. lol (we will both be 50 this year) At what point are you happy with your numbers? Are you striving to be 1%ers? Though I guess you could be 1% at 30 and then if you did FIRE would that be enough? So many variables. I guess I need to stick to not comparing with others because every situation is different.