WinterSolider

Mouseketeer

- Joined

- Feb 21, 2024

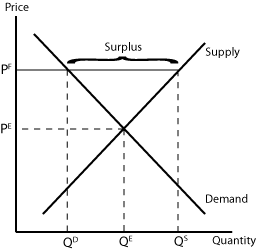

Price floors create artificial surplus. Obviously it's LEGAL, I never said otherwise. The problem is that Disney (as the buyer) doesn't actively go out and buy contracts.But the ROFR plays into market price just the same which, truth be told, is Disney's legal way of manipulating the market to protect their interests.

A cash buyer might be willing to pay way over market value for a home which doesn't need an appraisal from a bank or lender, which shows up eventually as sales history.

If Disney wants a contract for $80 and I'm willing to sell it for $80, THAT would be price equilibrium. But in order for that transaction to occur, some random third party person has to come in and offer me $80 to trigger the ROFR process. But because that person knows that Disney will take the contract out from under them, they have no reason to make the offer even if they would otherwise be happy with the $80 price too.