Thanks. I plan to probably just get the new card for the sub and cancel after a year. Not sure about changing my "daily spending" habits too much based on this new card.Yes, you can combine all URs onto your CSP.

I put all charges on my biz cards, not just those for the business.

I usually pick CIC because I buy the no fee VGC/MCGC at staples for 5x. I can use on utilities, property taxes, …. If I have upcoming expenses where I can’t use GCs, I go for the CIU. Both are URs and I pool on my CsR. I’d do a quick analysis of how many URs you expect to earn (ie any GCs, or other extra categories) and pick from there.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I love credit cards so much! v6.0 - 2023 (see first page for add'l details)

- Thread starter miztressuz

- Start date

MsOnceUponATime

DIS Veteran

- Joined

- Sep 10, 2014

Back to this... Unfortunately I'm in the paying (quite a bit!!) category this year. I filed and the IRS accepted my return today. Do they notify me when I'm "able" to pay my taxes? I selected "pay by check" just to get through the chaos and get them filed.Yes. Easy to google it. Format is better than my copy/paste. there are 3 processors -

1)payUSAtax

Paying by debit card?

$2.14

Paying by credit card?

1.82%

Minimum fee $2.69

Payment accepted

Debit/Credit card

Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE, Accel

Digital wallet

PayPal, Click to Pay

2)Pay1040

Paying by consumer or personal debit card?

$2.50 or 1.87%

Paying by credit card?

- $2.50 flat fee for consumer or personal debit card

- 1.87% for other debit cards

(minimum fee $2.50)

1.87%

Minimum fee $2.50

Payment accepted

Debit/Credit card

Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE, Accel, AFFN, Cirrus, Interlink, Jeanie, Shazam, Maestro

Digital wallet

Click to Pay; PayPal

Pay with cash

VanillaDirect

3)ACI Payments, Inc.

Paying by debit card?

$2.20

Paying by credit card?

1.98%

Minimum fee $2.50

Payment accepted

Debit/Credit card

Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE

Digital wallet

PayPal, Click to Pay, Venmo

Pay with cash

VanillaDirect

wannabee

DIS Veteran

- Joined

- Jun 8, 2005

If paying by check, you should mail your payment by 4/15Back to this... Unfortunately I'm in the paying (quite a bit!!) category this year. I filed and the IRS accepted my return today. Do they notify me when I'm "able" to pay my taxes? I selected "pay by check" just to get through the chaos and get them filed.

Crazed4DisneyinSC

DIS Veteran

- Joined

- Aug 21, 2019

Yeah I don't think there's any "notification" that comes, unless you are overdue and IRS sends you a bill. I just went on to pay my taxes once I got the "Accepted" message from the IRS. I haven't had an issue (the last 2 years that we've owed) submitting this way and having the payment attached to our account.Back to this... Unfortunately I'm in the paying (quite a bit!!) category this year. I filed and the IRS accepted my return today. Do they notify me when I'm "able" to pay my taxes? I selected "pay by check" just to get through the chaos and get them filed.

Ah, good point!! I spend way more than $6K in groceries!Your Blue Cash Preferred only gives 6% on the first $6k. I only have two boys but I know my grocery costs are much more than $500/month. I couldn't imagine what it would be with 4. The Gold offers 4x on up to $25k. Depending on where you are, it also includes Meijer stores which sells just about everything.

Great point! We are within driving distance of BDL (about 90 minutes for us)Not sure where exactly you're located but sounds like you could be in driving distance of Hartford/BDL. BOS/PVD are our airports, too, but sometimes it's enough of a savings that we drive the 2 hours to BDL. Just something to keep in mind in your searches!

ten6mom

DIS Veteran

- Joined

- Aug 28, 2012

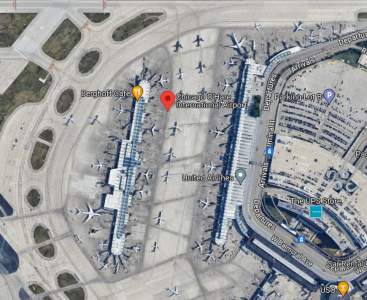

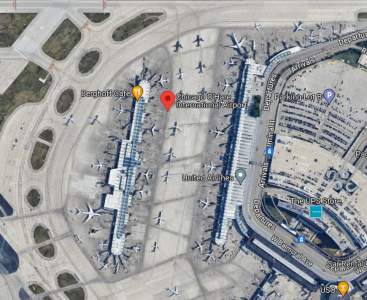

O'Hare experts:

I have a flight next week that connects there both directions... on United. Per the airport website it says United is in Terminal 1. An airport map seems to indicate that Terminal 1 is actually in two different buildings- it looks like a main building and then an additional one hanging out by itself. I assume that since my connection is on a smaller regional plane, I'll have to get to/from that additional building. I don't see anything on the website about how to do that. Can anyone help? (PS I've never flown through Chicago before.. those runways look pretty crazy to me!)

I have a flight next week that connects there both directions... on United. Per the airport website it says United is in Terminal 1. An airport map seems to indicate that Terminal 1 is actually in two different buildings- it looks like a main building and then an additional one hanging out by itself. I assume that since my connection is on a smaller regional plane, I'll have to get to/from that additional building. I don't see anything on the website about how to do that. Can anyone help? (PS I've never flown through Chicago before.. those runways look pretty crazy to me!)

MsOnceUponATime

DIS Veteran

- Joined

- Sep 10, 2014

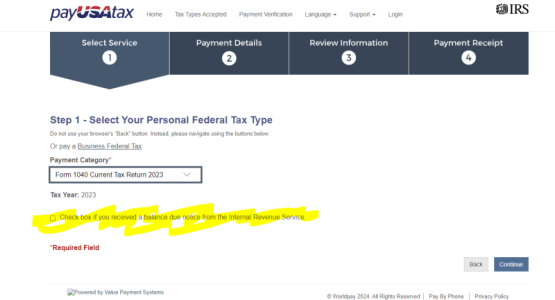

Sorry - additional question - my first time paying ever.. where do you go to pay? Simply one of those websites that I quoted above to use my cc? I'm unclear on how to access MY personal info to pay on MY taxes. I opened up a new biz card specifically for this!Yeah I don't think there's any "notification" that comes, unless you are overdue and IRS sends you a bill. I just went on to pay my taxes once I got the "Accepted" message from the IRS. I haven't had an issue (the last 2 years that we've owed) submitting this way and having the payment attached to our account.

Edited to add - this little check box is what's throwing me off. I have been thinking that I was waiting for an email notification saying that I do, in fact, owe - from the IRS via email (or something) after they accepted my return.

Last edited:

palhockeymomof2

DIS Veteran

- Joined

- Nov 14, 2001

Hoping to get advice on starting to use rewards cards. Wife and I both have no new cards last 24 months, Southwest Airlines is nearby, our credit scores are about 820, our goals are disney trip, possible family trip to Ireland. Advice greatly appreciated! The whole process seems a little overwhelming and a road map would be a great help. Thanks in advance!

From your username I’m assuming you live on LI….i do as well and fly SW out of Islip all the time to visit my son and his family in Orlando.

From your username I’m assuming you live on LI….i do as well and fly SW out of Islip all the time to visit my son and his family in Orlando. I second the advice you received to start with Chase cards to collect URs…you could also open SW cards to accumulate RR points to book SW flights with

MsOnceUponATime

DIS Veteran

- Joined

- Sep 10, 2014

The irony here... lol.. I've always thought that you were from PA based on your username!!From your username I’m assuming you live on LI….i do as well and fly SW out of Islip all the time to visit my son and his family in Orlando.

I second the advice you received to start with Chase cards to collect URs…you could also open SW cards to accumulate RR points to book SW flights with

EACarlson

DIS Veteran

- Joined

- Jan 27, 2019

United is actually in Terminal 1 and Terminal 2. Most of the regional flights seem to come into T2 in the F gates, some of them come in the B gates. The C gates are what you see out in the outbuilding. There is a tunnel that takes you under the apron to get out there with moving sidewalks.O'Hare experts:

I have a flight next week that connects there both directions... on United. Per the airport website it says United is in Terminal 1. An airport map seems to indicate that Terminal 1 is actually in two different buildings- it looks like a main building and then an additional one hanging out by itself. I assume that since my connection is on a smaller regional plane, I'll have to get to/from that additional building. I don't see anything on the website about how to do that. Can anyone help? (PS I've never flown through Chicago before.. those runways look pretty crazy to me!)

View attachment 849490

miztressuz

DIS Veteran

- Joined

- Feb 23, 2011

Not as cool as @platamama but I got a bit of diamond ring today. Giant cloud moved in right at totality so no clean shots. I hope everyone's eclipse travels work out today!

Attachments

Crazed4DisneyinSC

DIS Veteran

- Joined

- Aug 21, 2019

I used the same site - payUSAtax. I did not check that box (since I didn't get a balance due notice), and I just clicked continue. On Step 2 it'll ask for all the information on the taxpayer name, ssn, etc. and it must match exactly (so that the payment can get matched to your return). The IRS has never sent me an email notification that I owed money; I don't believe they do that. The only thing they'd do is send a balance due notification (which I believe comes by mail) I guess if it wasn't paid by April 15th.Sorry - additional question - my first time paying ever.. where do you go to pay? Simply one of those websites that I quoted above to use my cc? I'm unclear on how to access MY personal info to pay on MY taxes. I opened up a new biz card specifically for this!

Edited to add - this little check box is what's throwing me off. I have been thinking that I was waiting for an email notification saying that I do, in fact, owe - from the IRS via email (or something) after they accepted my return.

View attachment 849499

ten6mom

DIS Veteran

- Joined

- Aug 28, 2012

Thank you! I have about a 90 minute layover on the outbound and a fabulous 3+ hours on the return so I feel like I should have plenty of time.United is actually in Terminal 1 and Terminal 2. Most of the regional flights seem to come into T2 in the F gates, some of them come in the B gates. The C gates are what you see out in the outbuilding. There is a tunnel that takes you under the apron to get out there with moving sidewalks.

palhockeymomof2

DIS Veteran

- Joined

- Nov 14, 2001

I can definitely understand why you’d think that…the pal part is the initials of the hockey organization my kids played for growing up…police athletic leagueThe irony here... lol.. I've always thought that you were from PA based on your username!!

CyndiLouWho

DIS Veteran

- Joined

- Feb 7, 2013

This was in Chicago area.Not as cool as @platamama but I got a bit of diamond ring today. Giant cloud moved in right at totality so no clean shots. I hope everyone's eclipse travels work out today!

Attachments

Judique

Dis Veteran, Beach Lover at BWV, BCV, HHI, VB

- Joined

- Aug 1, 2003

Sorry - additional question - my first time paying ever.. where do you go to pay? Simply one of those websites that I quoted above to use my cc? I'm unclear on how to access MY personal info to pay on MY taxes. I opened up a new biz card specifically for this!

Edited to add - this little check box is what's throwing me off. I have been thinking that I was waiting for an email notification saying that I do, in fact, owe - from the IRS via email (or something) after they accepted my return.

View attachment 849499

Ignore the check box unless you got a snail mail notice.

I've been paying online since the last 5 years, since retirement as it's usually a peanuts amount like $98 or something similar. They'll ask for your tax info such as SSN, name, etc and then your method of payment and off the money goes to the IRS. Well, actually, this year I made 2 payments and each generated a confirmation email for the fee and a confirmation email for the actual amount being sent to IRS.

Crazed4DisneyinSC

DIS Veteran

- Joined

- Aug 21, 2019

Preview of the first week of Daily Getaways is out. These go live next week, starting April 15th. Weirdly, I can't view the previews on the computer, but pulling up the link on my phone shows me the full week of previews. Looks like it's mostly hotel points, some Universal/Sea World offers as well.

https://dailygetaways.ustravel.org/Home/Index/2024-04-15

https://dailygetaways.ustravel.org/Home/Index/2024-04-15

Judique

Dis Veteran, Beach Lover at BWV, BCV, HHI, VB

- Joined

- Aug 1, 2003

I looked at them. The IHG points are at $5 per thousand (if I did the math correctly) which is a bit cheaper as mostly I'm seeing $6 per thousand on the IHG website looking at cash and points. This is not enough for me to stock up as I've got a little stash from my last card. The rest of the offers were not anything I wanted.Preview of the first week of Daily Getaways is out. These go live next week, starting April 15th. Weirdly, I can't view the previews on the computer, but pulling up the link on my phone shows me the full week of previews. Looks like it's mostly hotel points, some Universal/Sea World offers as well.

https://dailygetaways.ustravel.org/Home/Index/2024-04-15

-

Super Nintendo World Revealed at Universal Epic Universe

-

Disney's Hollywood Studios 35th Anniversary Celebration Ceremony

-

New Disney Parks Merch: 'Partners' + Disneyland & WDW Shirts

-

Shopping Disney's Hollywood Studios 35th Anniversary Merch

-

New Menu Items at Morimoto Asia Street Food Disney Springs

GET A DISNEY VACATION QUOTE

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!