No cards applied for in the past 2 years. Mine are very old, mostly with Citi, one unused CapOne Silver

Monthly: $3-4000 that could be paid on a card instead of debit

Paid off monthly

Airport: DTW

Preferred Airline: Delta

Southwest services DTW but not a lot of non-stop routes we would take so it is not preferred.

No preference on hotels other than Disney

We have some Delta direct miles

Goal: Discounted flights to Disney/Orlando and savings on Disney vacations, preferably as DVC members soon

Trips: At least annually

Travel only with spouse usually.

You have gotten some good advice and I'm going to throw some more food for thought your way. Keep in mind as you enter this hobby, your goals can change. When I started this hobby back in 2012 I was only planning to do this for one trip to Scotland. That was it. This hobby literally changed my life and my perspective and here I am doing things and going places that I never thought were possible.

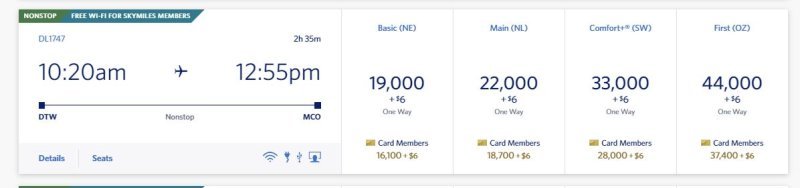

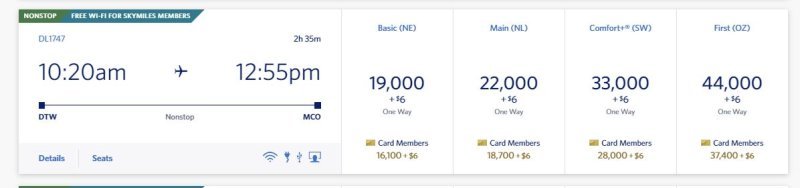

Lets take a look at a random one way flight from DTW-MCO this summer on DL with miles and with money to compare. Same flight, same day. I'm going to go with the assumption that you would choose Main cabin over basic so you have some flexibility in case you need to make a change, seat selection available etc. If not, adjust my math accordingly.

The ticket is $244 and if you hold a Delta Gold, Platinum or Reserve card you save 15% on the miles needed and can book that ticket for 18.7k miles and $6. The cpp on that is .013 plus your $6. So now you need to take into account what does it cost you to hold a Delta cobranded card long term. Let's go with 5 years. The DL gold card is $150/year with the first year AF waived. Over 5 years the card costs you $600. Amex has a one card per lifetime rule plus card family restrictions on the consumer card. So you're only getting the one card for you and maybe one for P2 adding to if you cancel P2s card at 1 year. Current bonus on the card is 40k miles for $2k spend in 6 months for the personal card or 55k for $4k spend on the biz card. The cards earns 2x on dining, groceries and Delta purchases on the consumer card. At two flights per year you save 33K DL miles with this card which is valued at $429 and you spent $600 to keep the card, earned 40k-55k miles for a bonus and can only use those miles earned for DL flights and you will not earn any FF miles for flying on an award flight booked with FF miles. The 40K miles are worth $520.

Another option would be have an Amex card that earns MRs since they can transfer to DL. Yes, there is a .0006 pp txfr cost specifically for Delta. The same flight would cost $13.20 to transfer Amex MRs to Delta. You still have to consider the lifetime Amex rule on the available cards. If you are comfortable with business cards, I'd go right out the gate with an Amex Platinum biz or Gold biz for the the higher sign up bonus. On the Plat it's 150k for $15k in 3 months and there are annual credits which if used strategically can offset that first year AF of $695. The gold biz is 130k MRs for $10k spend in 3 months and the AF is $375. What is more compelling to me about this one is the $20 monthly statement credit at office supply stores. You can purchase gift cards like

Amazon, Delta or wherever you shop normally at an office supply store for $20 each month to offset the fee which would bring it down to $135. If gas and dining are your two most frequent spend categories each month you'd also get 4x for that. Then, at one year, before canceling the card I would the get the Amex Blue Business Plus which is a no fee card that will keep your MRs alive and transferrable to airlines. The spend is high for the meager SUB but I’d do it and not make the spend to keep the MRs alive. It earns 2x on everything up to $50k spend per year. Some would say get the SUB for that one also rather than product change but the SUB isn't often that good. You could get the SUB for the Everyday preferred card which is a $95 AF and has decent earnings for groceries at 3x and a 50% bonus on MRs earned when you make 30+ purchases per month as another option. 130K MRs on the biz gold are worth $1690 as DL miles in our scenario above. The 150k MRs are worth $1950, an AF of $695 on year one and $95 on years 2-5 comes out to $1075 and you're still ahead on a consumer card with getting the everyday preferred card before you cancel the plat card. The 130K MRs on the biz gold are worth $1690 as DL miles in our scenario above. However, when you PC to a Blue Business Plus card after year one, the years 2-5 and on are $0 so your OOP cost for the card was only $375.

Anyhow, all of this is to give you some ways to look at the big picture, your long term strategy and make the best decisions for your family and travel goals. Hope it helps

…can’t hurt to try to have it expedited

…can’t hurt to try to have it expedited …can’t hurt to try to have it expedited

…can’t hurt to try to have it expedited…can’t hurt to try to have it expedited

You have gotten some good advice and I'm going to throw some more food for thought your way. Keep in mind as you enter this hobby, your goals can change. When I started this hobby back in 2012 I was only planning to do this for one trip to Scotland. That was it. This hobby literally changed my life and my perspective and here I am doing things and going places that I never thought were possible.

You have gotten some good advice and I'm going to throw some more food for thought your way. Keep in mind as you enter this hobby, your goals can change. When I started this hobby back in 2012 I was only planning to do this for one trip to Scotland. That was it. This hobby literally changed my life and my perspective and here I am doing things and going places that I never thought were possible.