Here's a story kinda related to our ongoing discussions about the BIZ of DIS.

https://www.fool.com/investing/2023...hoo-host&utm_medium=feed&utm_campaign=article

Is It Too Late to Buy Roku Stock?

By

Jeremy Bowman–Aug 2, 2023 at 6:40AM

Key Points

Roku shares popped after topping analysts' estimates in its recent earnings report.

Advertising demand remains challenged, especially in media and entertainment, its biggest vertica

The long-term growth opportunity still looks significant.

The streaming stock is soaring this year. Here's why it could have more room to run.

After years of pouring billions of dollars into new content, streaming services are being confronted with the harsh economics of the emerging industry. Every service except for

Netflix (NASDAQ: NFLX) is losing money on streaming, or believed to be.

Legacy services from the likes of

Disney (NYSE: DIS),

Warner Bros. Discovery (NASDAQ: WBD), and

Paramount Global (NASDAQ: PARA) are cutting costs to drive profitability as subscriber growth slows across the industry.

On top of that, the streaming arena is also facing challenges from the writers' and actors' strikes, as well as the broader downturn in digital advertising, which impacted ad-based streaming tiers and connected TV more broadly.

Roku (

ROKU 1.27%) stock surged on its latest earnings report after the streaming platform topped estimates, but isn't immune to these challenges. Its second-quarter numbers show the company continues to lose money even as it starts to recover from the worst of the digital advertising slowdown.

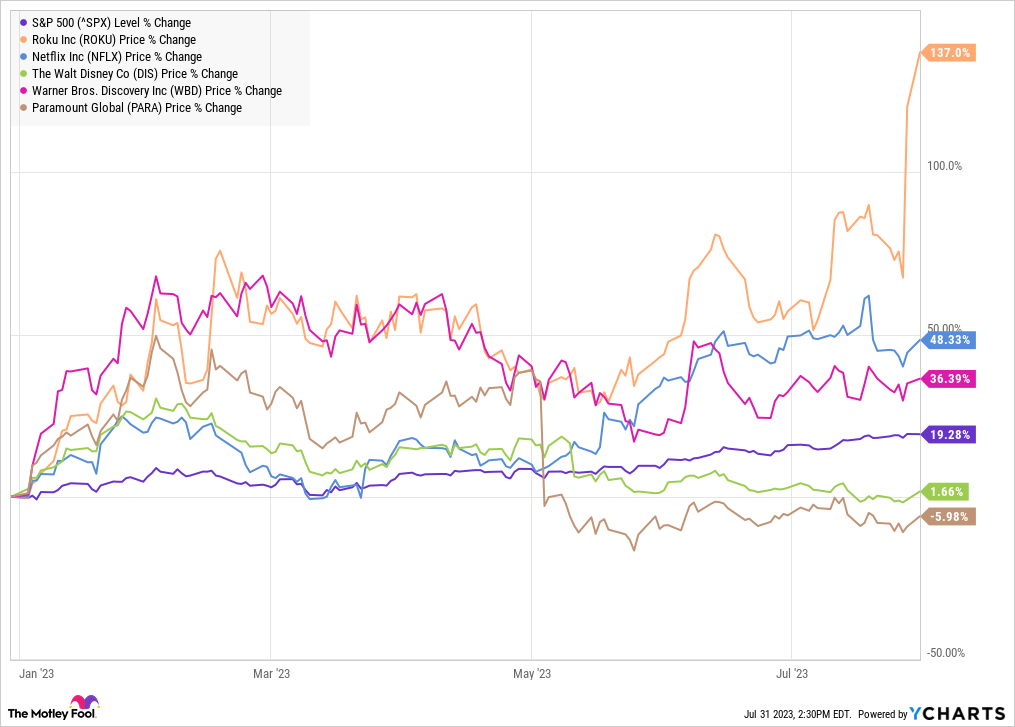

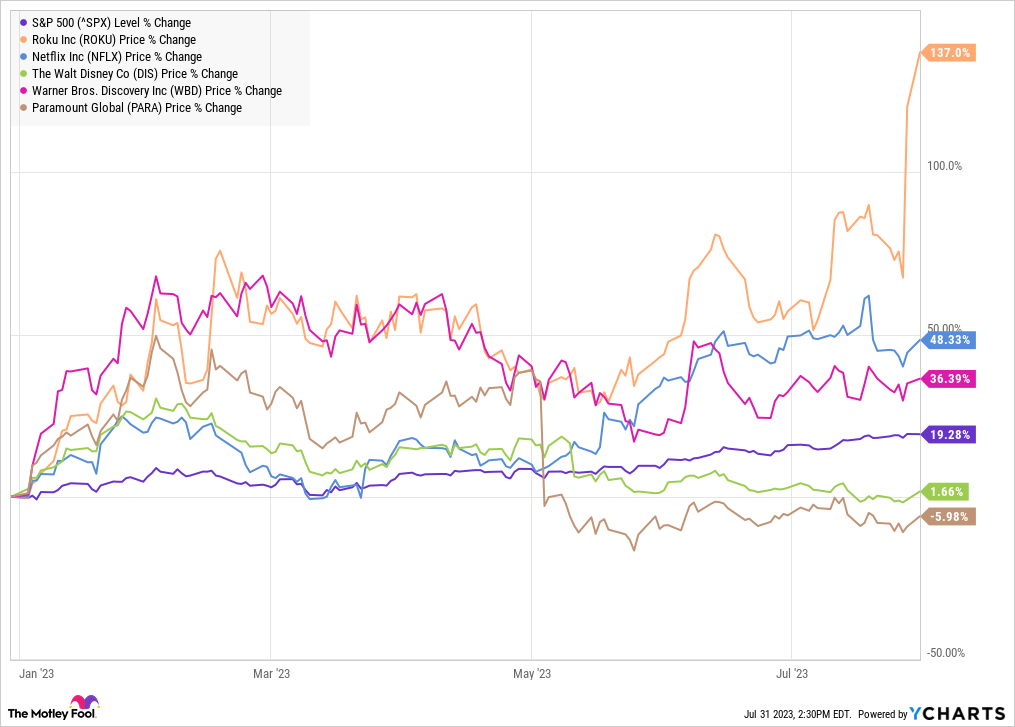

Nonetheless, the stock has had a banner year thus far in 2023, rebounding from a sharp sell-off in 2022. As you can see from the chart below, it more than doubled this year, easily outpacing its streaming peers.

^SPX

^SPX data by

YCharts

Why Roku stock is soaring this year

There are a number of reasons why Roku stock is up 136%.

First, investors who bought at the beginning of the year benefited from a sharp sell-off last year as revenue growth stalled and losses mounted. The stock fell more than 90% from peak to trough.

However, the second-quarter results show Roku beginning to emerge from the worst of the digital advertising slowdown. Revenue growth improved to 11%, its fastest clip since Q3 2022. Roku also narrowed its adjusted earnings before interest, taxes, depreciation, and amortization (

EBITDA) loss sequentially, which came in at a loss of $17.8 million, its best result in four quarters.

Even as it struggles financially, the company is still seeing strong growth in usage, a reminder that streaming continues to rapidly take viewing share from linear TV even if the industry is experiencing difficulties.

Roku's streaming hours in the quarter rose 21% from a year ago to 25.1 billion, and active accounts increased 16% to 73.5 million. Account growth is coming from both domestic sign-ups and the international market. The company was the No. 1 selling smart TV OS in Mexico for the third quarter in a row, and also launched its licensing program in Central America, expanding its addressable market.

Is it too late to buy Roku stock?

Most digital advertising platforms have seen significant slowdowns in ad growth over the last year, so it's clear that Roku's problems are due to cyclical headwinds, rather than its own mistakes.

On the

earnings call, management stressed that media and entertainment (M&E), which is historically its largest and highest-margin vertical, remains challenged, in part due to the broader challenges in the streaming sector and the Hollywood strikes.

It makes sense that M&E is such a valuable ad vertical for Roku because it's at the bottom of the viewing decision funnel for its 73 million household users. If you're a media company trying to get an audience for a new program, Roku is a natural place to advertise.

However, the company warned of continued headwinds in M&E into the third quarter, so investors should temper their expectations for a quick turnaround in Roku's business even as it continues to target a positive adjusted EBITDA profit for 2024.

Nonetheless, Roku remains the clear leader among streaming distribution platforms and its Roku Channel is even gaining traction, with an audience in the U.S. that now roughly matches that of Peacock and HBO Max.

There's also still a lot of growth ahead for the streaming platform because streaming made up just 36% of viewing time in the U.S. in May, according to

Nielsen.

With platforms like Netflix and Disney recently adding an ad-based tier, there should be a lot of growth ahead in ad-based streaming, and Roku is well positioned to capture it.

While its recovery is likely to be lumpy given the challenges in media and entertainment and the tech sector, Roku is still the leader in an industry with a large and expanding addressable market.

With a market cap around $13 billion, the stock continues to have a lot of upside potential.