https://www.ft.com/content/0a182c97-6af7-42a6-ad9f-ae980562bb45

Investor Nelson Peltz: ‘I’m not trying to fire Bob Iger, I want to help him’

The billionaire on his fight to fix Disney, keeping politics out of the boardroom — and why he is backing Trump again© by Harriet Agnew - 3/22/24

At lunch as in business, Nelson Peltz makes his preferences known. Sweeping past the row of pink bougainvillea into Trevini in Palm Beach, the octogenarian activist investor and father-in-law of Brooklyn Beckham greets me, then turns to the waiter: “Can you turn the music down? We have important stuff to talk about.”

It’s the proprietor’s prerogative — Peltz’s 19-year-old investment firm, Trian Partners, owns the building and the Italian restaurant is their de facto canteen. Soon the elevator-style music quietens down and we settle at our table on the outdoor terrace.

Peltz, 81, dressed in the off-duty-billionaire uniform of navy blue polo shirt and zip-up jumper, is a busy man. He’s waging his second proxy fight in as many years at US entertainment group Walt Disney; he’s trying to sharpen up Unilever, the maker of Marmite, Dove soap and Hellmann’s mayonnaise; and he’s “reluctantly getting involved in US politics again”.

A self-styled “constructivist”, Peltz is best known for his turnaround campaigns at big consumer goods companies such as Mondelez, Heinz and Procter & Gamble. Trian’s playbook is to buy a stake in a listed company and agitate for improvements, often by seeking a board seat and sometimes pushing for divisions to be broken up or sold.

Unlike the corporate raiders of the 1980s and the private equity firms, their modern counterparts, Peltz aims to win over management and other shareholders with the power of analysis and argument. “We don’t leverage up, we don’t buy all this funny money crap, we buy old-fashioned stock and work it hard,” he says. “We’re there to help these companies . . . not to break them up for immediate gain and leave them lying by the road.”

But the advances of Peltz and his ilk aren’t always welcomed and

recent research by Goldman Sachs casts doubt on whether activist investors actually add value in the long run. Other critics have suggested that activists take credit for improvements the company would have made anyway.

Peltz has a deep voice, a piratical charm and an uncompromising approach — “a case of the cure being worse than the disease”, says one critic. The wedding planners he hired six weeks before his daughter Nicola’s wedding to Beckham Jr and let go nine days later dubbed him a “bully billionaire” in a lawsuit.

“A what billionaire?” he shoots back when I ask about this.

“A bully billionaire.”

“That’s probably true,” he laughs. “What sense is being a billionaire if you’re not a bully? Let me tell you something . . . They got a great deal for doing nothing. But that’s water under the bridge.”

Dismissing my suggestion of a glass of wine — “very rarely do I drink wine. I prefer a Pepsi Max . . . or a Frosty” (the signature milkshake of American fast-food chain Wendy’s, where he’s chair of the board) — Peltz orders an English breakfast tea, and I some sparkling water.

Palm Beach has been Peltz’s stamping ground since the 1980s. “This place has become unlike any place in America,” he enthuses. Referring to the cut-and-thrust culture and low tax regime that have lured magnates to southern Florida, he goes on: “You’ve got so many meat eaters, carnivores . . . All my friends live on the same street” — South Ocean Boulevard, a stretch of ultra-exclusive waterfront properties bordered to the east by the Atlantic.

Montsorrel, aka Maison Peltz, is the stuff of Palm Beach legend. Originally called The Towers, it was owned by the railroad magnate Robert Young and his wife Anita O’Keeffe (sister of artist Georgia O’Keeffe). After Young shot himself in The Towers in 1958, his widow demolished the house and replaced it with a giant neoclassical mansion. “She built this house to show that she had not run out of money,” says Peltz.

He and his wife Claudia bought the property in 1987 and have subsequently expanded it. Claudia is mother to eight of Peltz’s 10 children — including two sets of twins, the youngest of whom are in their early twenties.

Menu

Trevini Ristorante

223 Sunset Avenue, Palm Beach, Florida 33480

Burrata x2 $58

Fish special x2 $82

Bottle San Pellegrino x2 $18

Hot tea x3 $15

Total inc tax and service $220

The waiter runs through the specials. I order the

burrata Pugliese to start, followed by snapper for the main course. Peltz opts for the same.

Palm Beach’s most (in)famous resident is Donald Trump, whom my guest has known for decades but — last we heard — disassociated himself from.

Peltz abstained from voting in the 2016 presidential election that put Trump in the White House, only to host a fundraiser for him during his 2020 campaign, when he was defeated by Joe Biden. Following the storming of the Capitol in January 2021, Peltz went on CNBC to apologise for supporting Trump’s re-election attempt.

Peltz is keen to stress that he has previously voted for Democrats: “I’m not one of these crazies who’s Republican or nothing.” He tried to convince Trump not to rerun for president, to be a kingmaker rather than a king, he goes on: “I thought we might get someone less controversial.”

So who will he back in this year’s contest? “I’m not ready to say that,” says Peltz. He changes his mind. “I’ll say it.” Long pause. “It will probably be Trump and I’m not happy about that.”

Peltz explains that his dramatic U-turn primarily reflects his worries about immigration. He is also concerned that 81-year-old Biden’s “mental condition is really scary” and thinks that the 91 criminal charges in federal and state courts that Trump is facing represent a “miscarriage of justice”.

America — financially and militarily — “is still as strong . . . but we are degrading,” he goes on. He is not seeking to stop immigration “but I want some boundaries put on it so we know at least who we’re bringing in”.

Peltz “may not” give Trump financial support. In February he and Tesla co-founder Elon Musk hosted a dinner at Montsorrel, he tells me. It wasn’t a fundraiser: it was “just to talk about what the country needed”.

But Peltz is ready to settle for “not a perfect candidate, nor is Biden . . . It looks like Trump is all we got.”

Peltz grew up in Brooklyn and later dropped out of Wharton business school because he was bored. He flirted with a career as an actor, even taking night classes with Stella Adler (teacher of Marlon Brando and Steve McQueen). After a spell as a “ski bum” was cut short by injury, in 1963 he went to work for his family’s wholesale frozen food distribution business. He ended up staying for 15 years.

To his father he credits his work ethic and teaching him the mantra “sales up, expenses down”. His father’s death at 76 — “As soon as he took it easy he got sick . . . showed me I need to keep working.” His mother lived to 108: “She was a tiger.”

As we begin our starters — slightly flavourless mozzarella and tomato in need of seasoning, with roasted peppers — Peltz tells the story of Triangle Industries, his focus in the 1980s. Fuelled by the junk bonds of his friend Michael Milken, he and his business partner Peter May built it into the largest packaging company in the world, before selling it. They later bought and lucratively sold the Snapple beverage business.

Together with his son-in-law Ed Garden, Peltz founded Trian in 2005. Since then they have taken on more than 30 of the world’s largest consumer, financial and industrial companies; their engagements range from behind-the-scenes dialogue to all-out proxy war.

One black mark was Trian’s $2.5bn bet on US conglomerate General Electric in 2015. “I regret buying GE . . . I was lied to . . . the numbers weren’t real,” says Peltz. In 2020 GE agreed to pay the US regulator $200mn for disclosure violations.

Disney is only the fourth proxy fight in Trian’s history. The most recent one — P&G in 2017 — marked one of the largest, most expensive and most dramatic proxy battles of all time, with Peltz claiming a board seat by a whisker following a recount.

Peltz likes to say that he’d rather be rich than be right. But while the P&G battle played out at the height of Trian’s power, the Disney proxy fight has coincided with a period of internal turbulence at the firm and muted performance.

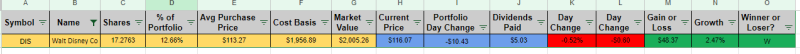

Last year Garden abruptly left Trian, which he had been expected to one day run. Assets have dropped from $12.5bn in 2015 to around $10bn today, including more than $2bn worth of Disney shares from Peltz’s friend Ike Perlmutter, which he lent to Trian’s proxy fight. According to Centerview Partners, Trian’s five-year annualised returns to September 30 were 6 per cent, trailing the equivalent of 10 per cent for the S&P 500. Trian has outperformed the S&P 500 since its 2005 inception.

Two of Peltz’s sons, Matt and Diesel, work at Trian. And Brad, another son, works for a Wendy’s franchisee. Diesel, says his father, has been helping him get to grips with the tech industry by introducing him to Silicon Valley entrepreneurs such as Elon Musk, Sam Altman and Travis Kalanick. But Peltz says he’s not ready to name his successor — “I’m not going anywhere, girl. I’ve got no plans to move. I love what I do and a succession plan will evolve when I leave but I’m going to leave with a fight . . . with whatever is pulling me away.”

Peltz insists he’s not an activist investor: “I wanted to invest in companies [that are] good companies but they’re just sort of missing it a little bit . . . That’s still the attitude.”

This neatly segues into Disney, where Peltz has been on the warpath. “Disney is stupid because I’m not trying to fire [chief executive] Bob Iger, I want to help him,” he says, unsolicited. “We don’t fire CEOs.”

By now our main course has arrived: filleted snapper in a gloopy artichoke, mushroom, tomato and white wine sauce, served with sautéed spinach.

Trian unveiled a $2.5bn stake in Disney in January 2023, criticising, among other things, the company’s $71bn acquisition of 21st Century Fox in 2017 that saddled it with debt, and the entertainment giant’s languishing share price and shrinking margins. But Peltz called off the proxy fight a month later, applauding Iger’s plan to cut costs and reinstate the dividend.

However, after growing impatient with a lack of progress, in November — much to Disney’s consternation — Peltz revived his campaign for board seats. Trian currently controls a Disney stake of around $3.5bn.

Disney said that Peltz has not “presented a single strategic idea” to the company during two years of campaigning for board seats. When I bring this up, Peltz launches into a critique of Disney’s movie business, which even Iger admits had a bumpy 2023. “They say we know nothing about the movie business — we don’t claim we do — but I don’t think they do, with five big losers in a row. They’ve lost first place in animation, they’ve lost first place in features . . . Maybe it’s time to change management in those divisions.”

Is it time for Kevin Feige to go, I ask, referring to the president of Marvel Studios who oversaw the highest-grossing film series of all time before the recent rough patch. “I’m not ready to say that, but I question his record.”

Peltz has previously called out Disney’s “broken” succession planning process that saw its long-standing boss Iger return to replace his handpicked successor after less than three years. He is critical of the $1bn that he says Disney executives have been paid over the past decade, while the share price has underperformed. “I love my CEOs to be the highest paid but shareholders have to participate,” he says.

It sounds like you

do want Iger to go. “No, I don’t. I don’t want Iger to go.”

Iger acknowledged last year that his company has focused too much on movie messaging and not enough on quality storytelling. Peltz agrees that Disney has become too woke. “People go to watch a movie or a show to be entertained,” he says. “They don’t go to get a message.”

The waiter comes to clear away the plates. Peltz has left half of his main course — “I wasn’t that crazy about it.” Returning to “woke” Disney, he takes aim at

The Marvels and

Black Panther, which portrayed female and Black superheroes respectively. “Why do I have to have a Marvel that’s all women? Not that I have anything against women, but why do I have to do that? Why can’t I have Marvels that are both? Why do I need an all-Black cast?”

A showdown is looming at Disney’s annual meeting on April 3. It could be a tight contest. JPMorgan Chase chief executive Jamie Dimon and influential proxy adviser Glass Lewis have backed Iger; while ISS, the other main proxy adviser, has recommended that Disney shareholders vote Peltz to the board.

Peltz has had more success recently at Unilever, which he has sought to streamline to improve margins. He was appointed to the board in May 2022 and on Tuesday Unilever announced it would split off its ice-cream business and cut 7,500 jobs.

He has been at loggerheads with Unilever’s ice-cream brand Ben & Jerry’s over its stance on Israeli politics. In 2021 Ben & Jerry’s attempted to stop selling its products in occupied Palestinian territories, prompting Unilever to sell the Israeli arm of the brand to a local licensee. More recently, in January Ben & Jerry’s board called for a permanent ceasefire in Gaza.

“You’ve got to get these politics out of the boardroom,” says Peltz. “Ben & Jerry’s job is to sell ice cream, not to make political statements. And these people use anything for a soap box that they have no right to do.”

Peltz continues: “I have my own feelings about a ceasefire. Israel has got to get a few things squared away before they get a ceasefire because what happened to them was despicable.”

Returning to putting profits before politics, he tackles the question of whether companies should continue to do business in Russia after it invaded Ukraine.

“I told Unilever not to pull out and so far they’ve listened,” says Peltz. “If we pull out of Russia, they will take our brands for themselves. I don’t think that’s a good trade.” Rivals such as P&G and Colgate-Palmolive didn’t pull out: “Why the hell should we? . . . We’re competing on the world stage with these products.”

We decline the waiter’s offer of dessert. I order a green tea; Peltz, his second English breakfast tea.

By this point, I have already fended off several interruptions from one son and two assistants trying to pull Peltz back to the office. But I haven’t come all the way to Palm Beach not to establish the veracity of

that topless tennis story that he has always maintained is apocryphal. Connie Bruck’s 1988 book

The Predators’ Ball recounts how Peltz and his late friend, corporate raider Saul Steinberg, once had four women play a game of topless tennis in which they were the only spectators.

“Another nonsense,” he says. “You know what’s great, is when we all were doing what we did in the ’70s, nobody had this [he picks up his cell phone] and there was a level of privacy to your life . . . And not that you want to do anything wrong but I think you’re entitled to some level of privacy sometimes. And I’m not talking about topless tennis, I’m just talking about your life.” Pause. “You were really digging deep there to get that one.”

“It’s everyone’s favourite story about Nelson Peltz,” I counter.

“You think so? I hope not. I hope I’m known for something other than that. You get a bad burn that way,” he says, laughing.

“So the topless tennis

is true?” I persist.

Peltz looks me in the eye through his horn-rimmed glasses and manages to both shake and nod his head all at the same time. You can’t hustle a hustler.

My guest is starting to get impatient. After one final overture to Iger — “We’re not there to fight. We’re there to help him” — we bid each other farewell. “I gotta go, girl,” says Peltz. “Be gentle with me.”

Harriet Agnew is the FT’s asset management editor