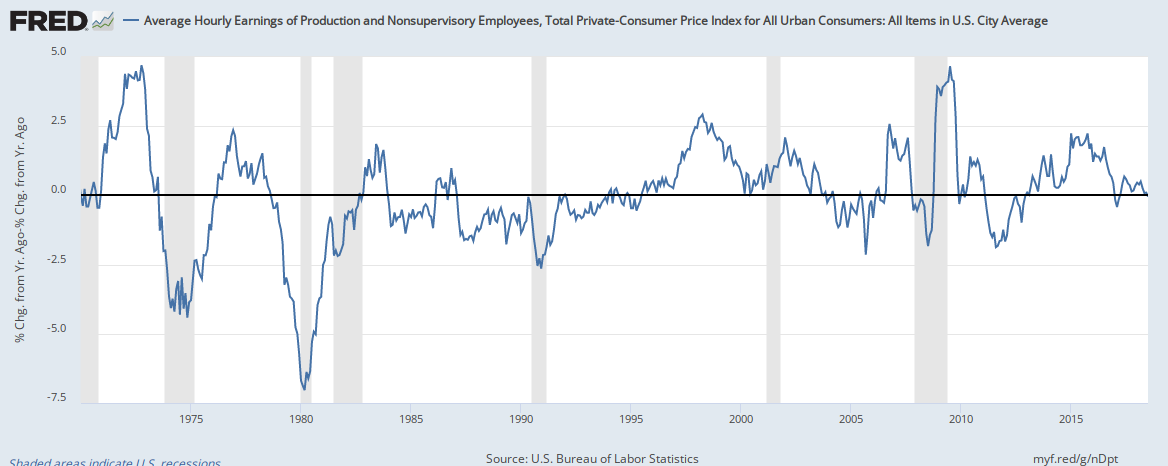

Wage stagnation explains much of that. Since the Recession of 1969–1970, almost every bit of prosperity (when wage growth exceed inflation) has been countered by decline (when inflation exceeds wage growth).

So while our economy (and our lives, really) have been structured around this expectation that we're living in a prosperous country - an expectation that would otherwise be reasonable based on data prior to the Recession of 1969–1970 - we spend money like we're living in a prosperous country. What's worse, most of the younger workers grew up in the longest period of prosperity the country experienced since 1969 - the seven years between 1994 and 2001. That has got to foster even more impetus to spend money.

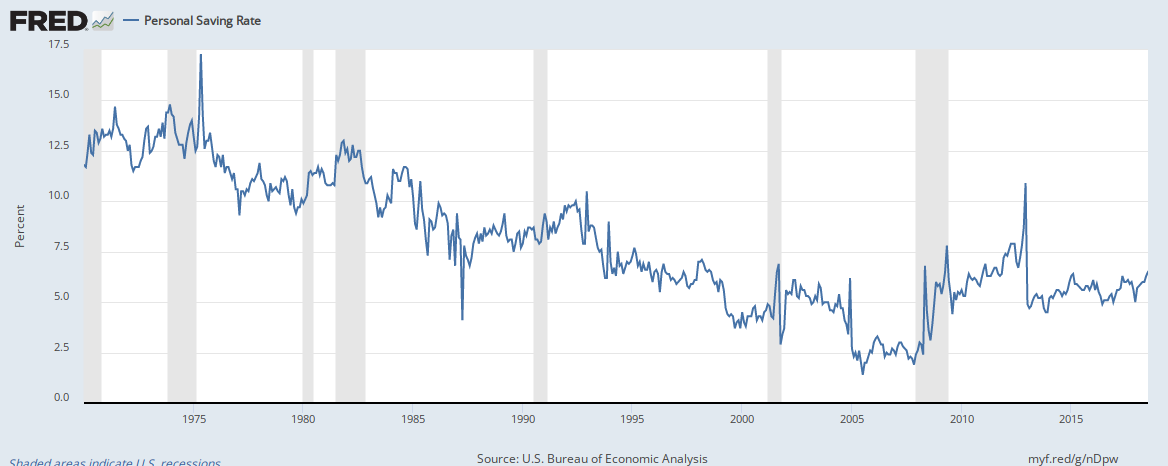

I don't believe it is that low.

Who knows where Marketwatch got their number. Maybe the author read the data wrong? Let's say the savings rate has declined to roughly 6%.

Money saved in a 401k is reflected in the Savings Rate.

.

.

I bought $300.00 worth of used Lego (which resulted in enough boxes to fill the trunk and backseat of my car at the time) in 1998. Sold enough to get my back my $300.00 immediately. Then continued to sell them off, set by set (Which I had to put together first to ensure all of the pieces were there.) until I had paid for our entire wedding with Lego profits. Then I stuck the remaining Lego in a closet for a couple years, and when I was pregnant with our first, I sold what was left to purchase everything we'd need for the baby.

I bought $300.00 worth of used Lego (which resulted in enough boxes to fill the trunk and backseat of my car at the time) in 1998. Sold enough to get my back my $300.00 immediately. Then continued to sell them off, set by set (Which I had to put together first to ensure all of the pieces were there.) until I had paid for our entire wedding with Lego profits. Then I stuck the remaining Lego in a closet for a couple years, and when I was pregnant with our first, I sold what was left to purchase everything we'd need for the baby.