You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Grand Californian - worth the $$$?

- Thread starter MomMaxer

- Start date

- Joined

- Feb 19, 2017

It's important to know that 1-bedrooms are easier to book at WDW resorts than any other type of room (not sure about VGC). I got nervous and bought some VGC points from someone via a transfer for our next trip to DL and rented out my VGF points to be net zero on the deal. When the 7-month window opened, I would have been able to book, FYI. Granted, we stay in 2-bedroom units which is easier to get than a studio. Keep in mind that studios are the hardest room type to book at all resorts. I would recommend that you buy at VGC and just rent your points out the first few times that you want to go to WDW and take a transfer from an owner at whatever WDW resort you want to stay. That will let you look at the 7-month availability when it comes up the first few times to see if you need to continue to do this or if you could just use your own points. Also, if you decide to stay at a resort which rents for less than VGC points, then you can make money off your VGC points that you aren't using that year to help cover some of the costs of the trip by renting them out. Everyone speaks in terms that you will almost NEVER be able to book at any of the popular resorts at 7-months which just isn't true especially when you are looking at something other than a studio and/or at a non-peak time. However, I do believe that you should buy where you want to stay because it is more difficult at popular times of the year. Also remember that if you buy via resale at one of the premium resorts which cost more (like VGC), you will rent those points out for more which narrows the spread on cash outlay between the cheapest resort and the most expensive.

Last edited:

bwvBound

DVC SSR & other timeshare

- Joined

- Feb 5, 2004

I'll open with our Contextual Details and go from there.I need help forming an opinion, hive mind activate! Thanks in advance.

Question 1: Is buying into the Grand Californian as our home resort worth the additional price per point over most Florida properties? This is a $15-20k decision for us, so...help!

Question 2: Is booking Grand Californian within the 7 mos window (if not one's own home resort) really that much of a challenge?

Contextual Details:

- We live in Seattle and love Disneyland. West coast travel is easier/cheaper for us.

- When we go to WDW, We'd likely explore and experiment around various WDW properties vs return over and over to just one resort.

- We will almost certainly buy all/bulk of our points on resale market.

- We want to have about 300-350 pts per year.

Talk to me. I'm all (mouse) ears.

- San Diego. Assume I grew up at DLR.

- DLR is ~90 minutes drive from home but the traffic is miserable and we prefer to stay a couple nights either at the Grand Cal or nearby (walking distance) over driving back and forth. The days of "drive up in the morning; hit the parks from morning through fireworks; drive home same day" are long behind us.

- We purchased DVC at SSR in early 2004, ~3 years before the Grand Cal was announced. We heavily debated adding points at the Grand Cal but, in the end, did not.

- We generally visit DLR two or three times a year.

- We own other timeshare, including Worldmark the Club (WM). WM has two properties near DLR, within walking distance. If I need particular dates, I will book one of the WM locations while fishing the Grand Cal waitlist. No pressure!

- Grand Cal studio units? Forget about them. They are unicorns. (Yes, we've booked them ... but they are rare!)

- Grand Cal 1BR units? Often available directly at the 7 month window for 2-4 nights. Don't plan on booking full week stays -- but short stays are quite possible.

- The Waitlist is your friend! I've been very successful booking short stays piece-by-piece using the waitlist. Again, 1BR units are easier to grab than Studios.

- Last minute stays? Possible, but only if you have the flexibility, as we do, to grab something just because you saw it suddenly appear online while stalking inventory.

Dean

DIS Veteran<br><a href="http://www.wdwinfo.com/dis

- Joined

- Aug 19, 1999

IMO I'd only buy there to stay there ALMOST all the time. And I would buy there to stay there most of the time only if I could and would book at 11 months out with little chance of changing. Now it might make sense to buy some there and some at WDW or it might make sense to buy at WDW and rent or pay cash for DL. Obviously these are all variables dependent on your specific situation and preferences.

CaliAdventurer

DIS Veteran

- Joined

- Oct 27, 2014

I had great success booking last year at 7 mos for 1 and 2 beds but this year, nope! I'm going to try one more year and if it's as tight when all the rooms are in service, I'm going to buy, maybe even direct if the prices are close and the inventory as slim.

MomMaxer

Earning My Ears

- Joined

- Aug 16, 2017

The direct sales person I talked to said the waiting list was closed so resale might be the only option here.I had great success booking last year at 7 mos for 1 and 2 beds but this year, nope! I'm going to try one more year and if it's as tight when all the rooms are in service, I'm going to buy, maybe even direct if the prices are close and the inventory as slim.

Matty B13

DIS Veteran

- Joined

- Jun 13, 2016

The direct sales person I talked to said the waiting list was closed so resale might be the only option here.

Ask for another guide, one that will do an informal waitlist

CaliAdventurer

DIS Veteran

- Joined

- Oct 27, 2014

Exactly. When we told them originally on the tour that we were firm and only interested in VGC because we are West Coast they were ready to sell us some.Ask for another guide, one that will do an informal waitlist

mentos

Minty fresh happy haunts

- Joined

- Aug 19, 2017

My first post! Hello everyone, long-time reader, first-time caller.

I agree with it being worth the money (approx. $145-$155/point for resales), I've stayed at DLH, GC, good-neighbor hotels, airbnb's within 15-20 minutes, and lived in Orange County, CA x 6 years. The ability to have a minimal walk and a direct entrance into DCA is a huge benefit.

I also have a 3 year old who naps in the afternoon and our current trips are very short (1-2 days, have to fly in), so any "reduction of friction" is a huge boon for us time-wise. On a 90 degree day, the walk from DLH (the other closest on-property hotel) to the main plaza burns, it was much more pleasant ducking into the GC entryway just past the WOD shop.

I can see how, as time goes by, this becomes less of an issue (as the kids age). Staying at VGC would be more of a treat than a "necessity" so I would advocate having multiple contracts (maybe 2 x 100 points or more) with the potential to sell them later down the road as your needs change. The resale market is robust here because supply is naturally tight.

That booking window is tricky though, you absolutely have to book 7-11 months out as < 7 months is taken up by other owners. We usually visit quarterly so our half our VGC stays will be planned ahead w/ DVC and the others will float and take advantage of hotel deals which can be as low as $400/night all-in during shoulder season & Sun-Thurs.

I agree with it being worth the money (approx. $145-$155/point for resales), I've stayed at DLH, GC, good-neighbor hotels, airbnb's within 15-20 minutes, and lived in Orange County, CA x 6 years. The ability to have a minimal walk and a direct entrance into DCA is a huge benefit.

I also have a 3 year old who naps in the afternoon and our current trips are very short (1-2 days, have to fly in), so any "reduction of friction" is a huge boon for us time-wise. On a 90 degree day, the walk from DLH (the other closest on-property hotel) to the main plaza burns, it was much more pleasant ducking into the GC entryway just past the WOD shop.

I can see how, as time goes by, this becomes less of an issue (as the kids age). Staying at VGC would be more of a treat than a "necessity" so I would advocate having multiple contracts (maybe 2 x 100 points or more) with the potential to sell them later down the road as your needs change. The resale market is robust here because supply is naturally tight.

That booking window is tricky though, you absolutely have to book 7-11 months out as < 7 months is taken up by other owners. We usually visit quarterly so our half our VGC stays will be planned ahead w/ DVC and the others will float and take advantage of hotel deals which can be as low as $400/night all-in during shoulder season & Sun-Thurs.

starry_solo

DIS Veteran

- Joined

- Nov 19, 2010

I live in SF Bay Area, recently purchased Aulani and also deciding whether or not to add a little VGC. If I attend a tour at Aulani, is there a better chance to get VGC direct add-on?

Nope. Just on the waitlist.

- Joined

- Feb 19, 2017

There is no waitlist for VGC and my guide recommended buying resale.

I can't believe that a guide actually endorsed resale in any capacity. Hopefully, DVD doesn't get wind of this even in this circumstance!

PasadenaJacket

Earning My Ears

- Joined

- Jan 31, 2017

I also did a cost comparison of the average resale purchase price, length of contract left, and annual dues and found that there was only about $5-6K/100 points in difference between the cheapest resort and the most expensive resort after 30 years (when we personally might be slowing down in age). That's not enough of a savings to gamble where I want to stay each year.

Is that something you could share? (the comparison)

Thanks

Dean

DIS Veteran<br><a href="http://www.wdwinfo.com/dis

- Joined

- Aug 19, 1999

I'd like to see the specifics also since I'm wiling to bet the TVM wasn't accounted for and that the cost was averaged over the 30 years, an approach I personally wouldn't agree with for either item. The up front difference alone on VGF and SSR is that much. In 30 years that $5K difference up front between SSR & VGF will be worth in the neighborhood of $50K if invested. The dues difference isn't much but is misleading because it takes a lot more points to stay at VGF than at SSR by roughly 50% thus a slightly higher dues per point but a lot more total. I think the real difference between SSR & VGF as the extremes resale is more in the $200K range roughly studio to studio for a week. Since one should only buy VGF to main (? only) stay at VGF and if they buy SSR, they're more likely to be using other locations, the real differences will be less for most people because they're likely to buy more points than just the minimum (and should) while at VGF there isn't any need to buy extra other than a cushion to guard against reallocations.Is that something you could share? (the comparison)

Thanks

PasadenaJacket

Earning My Ears

- Joined

- Jan 31, 2017

I'd like to see the specifics also since I'm wiling to bet the TVM wasn't accounted for and that the cost was averaged over the 30 years, an approach I personally wouldn't agree with for either item. The up front difference alone on VGF and SSR is that much. In 30 years that $5K difference up front between SSR & VGF will be worth in the neighborhood of $50K if invested. The dues difference isn't much but is misleading because it takes a lot more points to stay at VGF than at SSR by roughly 50% thus a slightly higher dues per point but a lot more total. I think the real difference between SSR & VGF as the extremes resale is more in the $200K range roughly studio to studio for a week. Since one should only buy VGF to main (? only) stay at VGF and if they buy SSR, they're more likely to be using other locations, the real differences will be less for most people because they're likely to buy more points than just the minimum (and should) while at VGF there isn't any need to buy extra other than a cushion to guard against reallocations.

5K becomes about 50K in 30 years if invested at 8%, and only if you invest the money in year 0 (not reinvesting the maintenance savings). Plus, you should really subtract away the effect of inflation.

I think your argument, which might make sense for VGF, would not be as compelling, made for VGC (on which, I believe, we started this discussion). VGC gets a premium because there aren't many alternatives for visiting DLR.

Dean

DIS Veteran<br><a href="http://www.wdwinfo.com/dis

- Joined

- Aug 19, 1999

That was the example, at the extremes per the quote you responded to. Since it was be a cash difference up front, it should be invested if not used thus it would be a direct and valid comparison. The $50K in 30 years would be affected by inflation in 30 yr from now dollars it'll be about half of the total $50K. Obviously if you reduce difference to almost nothing on both the up front cost and the points costs, the dollars change dramatically. Obviously this is just one factor of many but it does serve to reveal the REAL cost of such a long term commitment. And it does serve to highlight the difference between buying to stay at SSR or OKW compared to the highest end options. In reality my costs are significantly less than even the lowest quoted here since most of my stays are by exchanging in but that's a whole other discussion with more education needed, more risk, more uncertainty and less choices.5K becomes about 50K in 30 years if invested at 8%, and only if you invest the money in year 0 (not reinvesting the maintenance savings). Plus, you should really subtract away the effect of inflation.

I think your argument, which might make sense for VGF, would not be as compelling, made for VGC (on which, I believe, we started this discussion). VGC gets a premium because there aren't many alternatives for visiting DLR.

Jperiod

I am the rebel spy!

- Joined

- May 20, 2008

That was the example, at the extremes per the quote you responded to. Since it was be a cash difference up front, it should be invested if not used thus it would be a direct and valid comparison. The $50K in 30 years would be affected by inflation in 30 yr from now dollars it'll be about half of the total $50K. Obviously if you reduce difference to almost nothing on both the up front cost and the points costs, the dollars change dramatically. Obviously this is just one factor of many but it does serve to reveal the REAL cost of such a long term commitment. And it does serve to highlight the difference between buying to stay at SSR or OKW compared to the highest end options. In reality my costs are significantly less than even the lowest quoted here since most of my stays are by exchanging in but that's a whole other discussion with more education needed, more risk, more uncertainty and less choices.

For sure! If we evaluated the lost opportunity cost for investing vs. ANY luxury purchase, there would be no question at all! Investing and renting instead of purchasing and owning would win hands down. Buuuut, how can you value peace of mind? Which is why I would buy.

Buying points to stay anywhere would be a different comparison as well, I agree. I was only comparing the cost of different points to stay ONLY at VGC. So I would need X amount of points to stay there, regardless of what home resort they originally had.

My spreadsheet is several months old, and had spring's resale numbers on it, so I'll try cleaning it up and put in some new numbers to see about posting. I didn't evaluate any of the resorts that have 25 years left since those weren't even a consideration for me.

Jperiod

I am the rebel spy!

- Joined

- May 20, 2008

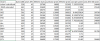

Hopefully this works! This compares only 100 point purchases. https://docs.google.com/spreadsheets/d/1NSfYCnmzyBGsQcRfFCzIGVMuebUEWF9UaZW3WGz1SSk/edit?usp=sharing

Dean

DIS Veteran<br><a href="http://www.wdwinfo.com/dis

- Joined

- Aug 19, 1999

One just needs to understand that the real dollars for any luxury purchase has significantly more cost long term than on the surface. If one adds other debt or financing to the equation, it further adds to the cost. In effect, every time one buys something with debt in their life, they are effectively financing a cash purchase that their highest interest rate.For sure! If we evaluated the lost opportunity cost for investing vs. ANY luxury purchase, there would be no question at all! Investing and renting instead of purchasing and owning would win hands down. Buuuut, how can you value peace of mind? Which is why I would buy.

Buying points to stay anywhere would be a different comparison as well, I agree. I was only comparing the cost of different points to stay ONLY at VGC. So I would need X amount of points to stay there, regardless of what home resort they originally had.

My spreadsheet is several months old, and had spring's resale numbers on it, so I'll try cleaning it up and put in some new numbers to see about posting. I didn't evaluate any of the resorts that have 25 years left since those weren't even a consideration for me.

-

The Pros & Cons of Disney's Character Dining + How To Choose

-

Enzo's Hideaway at Disney Springs to Host Bootlegger's Dinner

-

Take a Flamenco Master Class at Jaleo Disney Springs

-

Disney's Coronado Springs Resort King Room Tour in 3D / VR at Walt Disney World

-

Who Needs a Chiropractor When You Have Disney's Star Tours?

GET A DISNEY VACATION QUOTE

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

New DISboards Threads

- Replies

- 0

- Views

- 24

- Replies

- 0

- Views

- 43

- Replies

- 0

- Views

- 43

- Replies

- 0

- Views

- 52