I know there are many on here that are great about financial issues (that's to the person who recommended OOMA, for $4/mo for a landline phone)

We live in northern NJ and own our home. We have approx. $250K to put down on another home (we are thinking a beach home, possibly LBI). The houses at the shore are probably $600-700K. We would plan on renting out the beach home for at least 6 weeks in the summer and would probably get $2K per week.

I need advice on if this is a good financial decision or who I could consult with to see if this would be a good decision. We would use the shore house ourselves for different times of the year when our children are off of school/weekend trips etc. We would be approx. 2 hours from the shore house. Any advice on how to research this issue? Bad idea/Good idea?

We live in northern NJ and own our home. We have approx. $250K to put down on another home (we are thinking a beach home, possibly LBI). The houses at the shore are probably $600-700K. We would plan on renting out the beach home for at least 6 weeks in the summer and would probably get $2K per week.

I need advice on if this is a good financial decision or who I could consult with to see if this would be a good decision. We would use the shore house ourselves for different times of the year when our children are off of school/weekend trips etc. We would be approx. 2 hours from the shore house. Any advice on how to research this issue? Bad idea/Good idea?

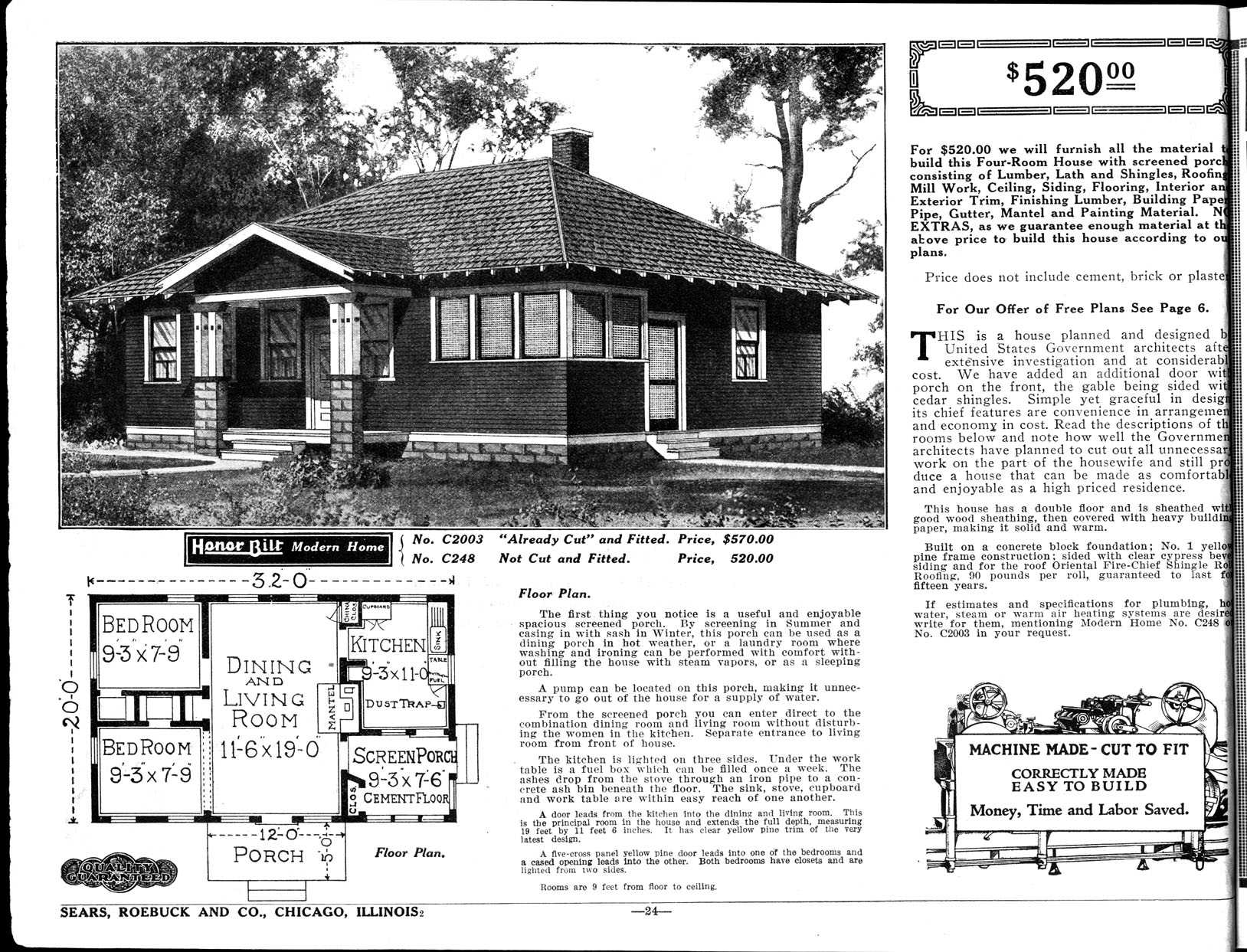

None of that was included in the original $520 retail price, nor was a foundation of any kind.

None of that was included in the original $520 retail price, nor was a foundation of any kind.