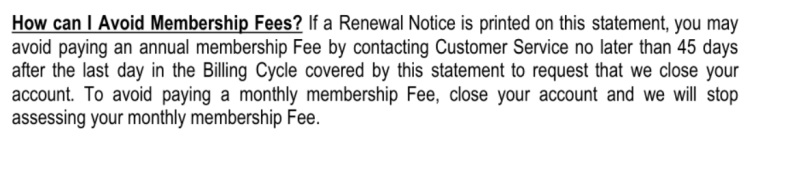

Don't forget you also get 10k anniversary points. Seems there may be DPs of the credit taking a while to post, so perhaps that's risky to try for? Also, seems C1 may work a little differently on AF refund requests at cancellation. So it sounds like there's speculation that Cap One issues a statement with a Renewal Notice (different from posting an Annual Fee). You have 45 days from the last day in THAT billing cycle to request account closure and avoid AF. Some are speculating that this gives you only about 15 days after AF posts. Might be ideal to check your statements now and see if you have that Renewal Notice. Please update us with some DPs. Some things I pulled from FT:

View attachment 711632

Q: if i may clarify that let's say AF is posted on Nov 1, C1 will issue a full refund up til Dec 15, correct?

A: No. The 45 days is measured from the statement on which the Renewal Notice appears, which is one month before the Annual Fee is billed.